Navigating India's 2025 Anti-Dumping Tariffs: How Huarong Secures Your 0% Advantage

2025-07-01 14:18:38

India’s 2025 anti-dumping ruling has introduced a significant shift in how plastic processing machinery is sourced across global markets. With tariffs now imposed on certain machines originating from China and Taiwan, manufacturers are reassessing cost structures, risk profiles, and supplier reliability. Among the exporters reviewed, Huarong Plastic Machinery Co., Ltd. was classified with a 0% duty rate. This article provides a factual overview of the policy background, explains how duties were determined, and outlines considerations for buyers navigating this new trade environment.

To understand India’s decision, it is essential first to recognize how anti-dumping (AD) measures fit into the broader framework of global trade. The World Trade Organization (WTO) allows its members to implement AD duties when certain conditions are met.

According to the WTO Anti-Dumping Agreement, dumping occurs when an exported product is sold at a price lower than its normal value in the market where it is sold. This can refer to the price in the domestic market or the cost of production plus a reasonable margin. When such practices cause material injury to the importing country’s industry, anti-dumping measures may be applied.

A country may impose anti-dumping duties (ADDs) if it establishes:

- The presence of dumping,

- Material injury to the domestic industry, and

- A direct causal link between the two.

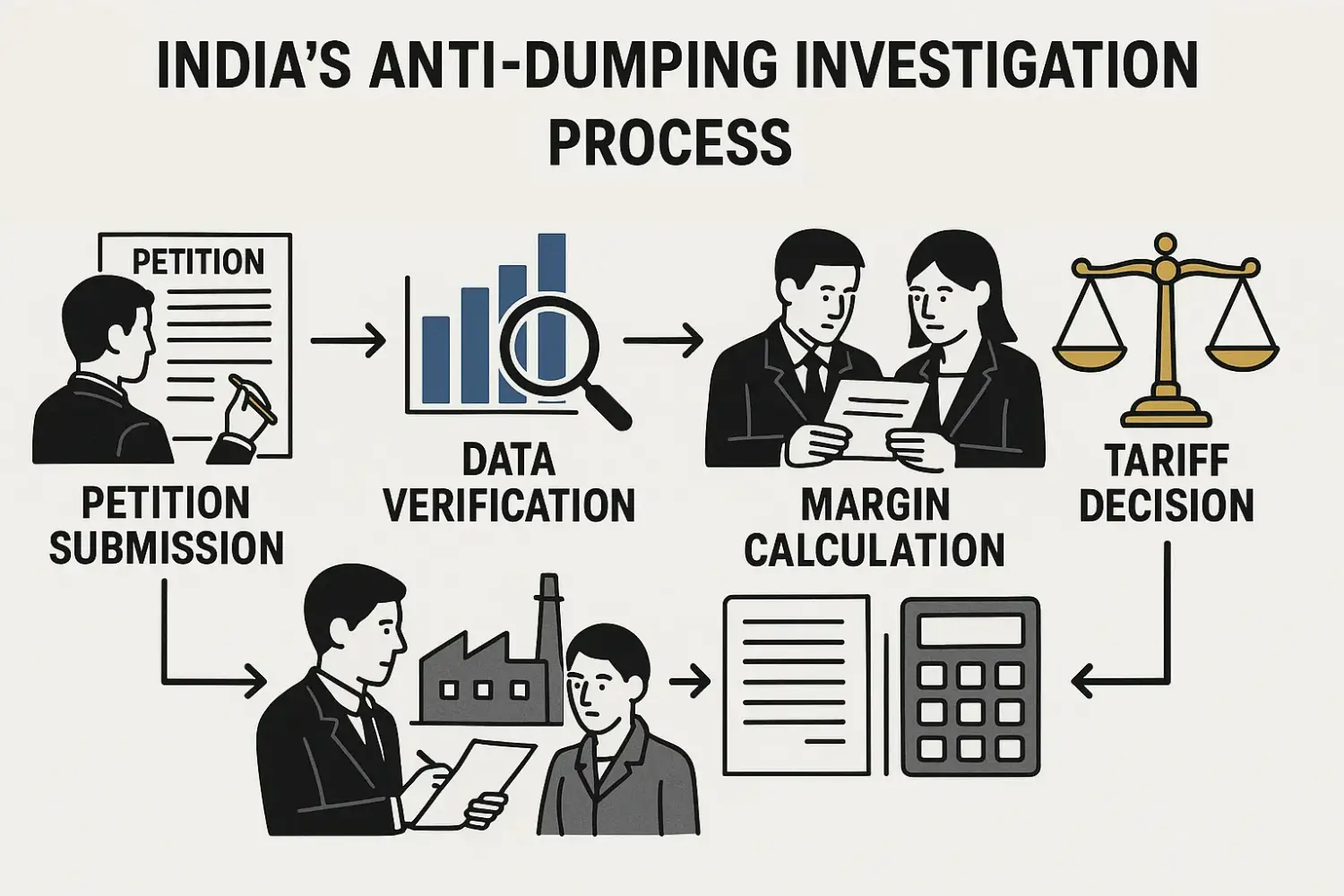

In India, the Directorate General of Trade Remedies (DGTR) is responsible for conducting anti-dumping investigations. Its approach is guided by structured procedures aligned with WTO norms. These procedures include data collection, on-site verifications, and margin calculations to ensure objectivity.

India’s DGTR follows a structured process that includes:

- Accepting petitions from domestic manufacturers,

- Sending questionnaires to exporters and verifying data on-site,

- Calculating a dumping margin (i.e., the percentage gap between export price and normal value),

- Recommending provisional duties, followed by definitive ADDs valid for five years.

For example, if a 650-ton injection molding machine sells domestically for USD 220,000 and is exported to India at USD 160,000 CIF, the dumping margin is calculated at 27.3%. This figure may serve as the basis for an anti-dumping duty. Exporters that can demonstrate price alignment and disclose all necessary data may be eligible for a lower or 0% rate, as was the case with Huarong.

India’s final decision was based on a multi-year investigation and input from both domestic stakeholders and foreign exporters. The outcome includes a classification of machine types, origin countries, and applicable tax rates.

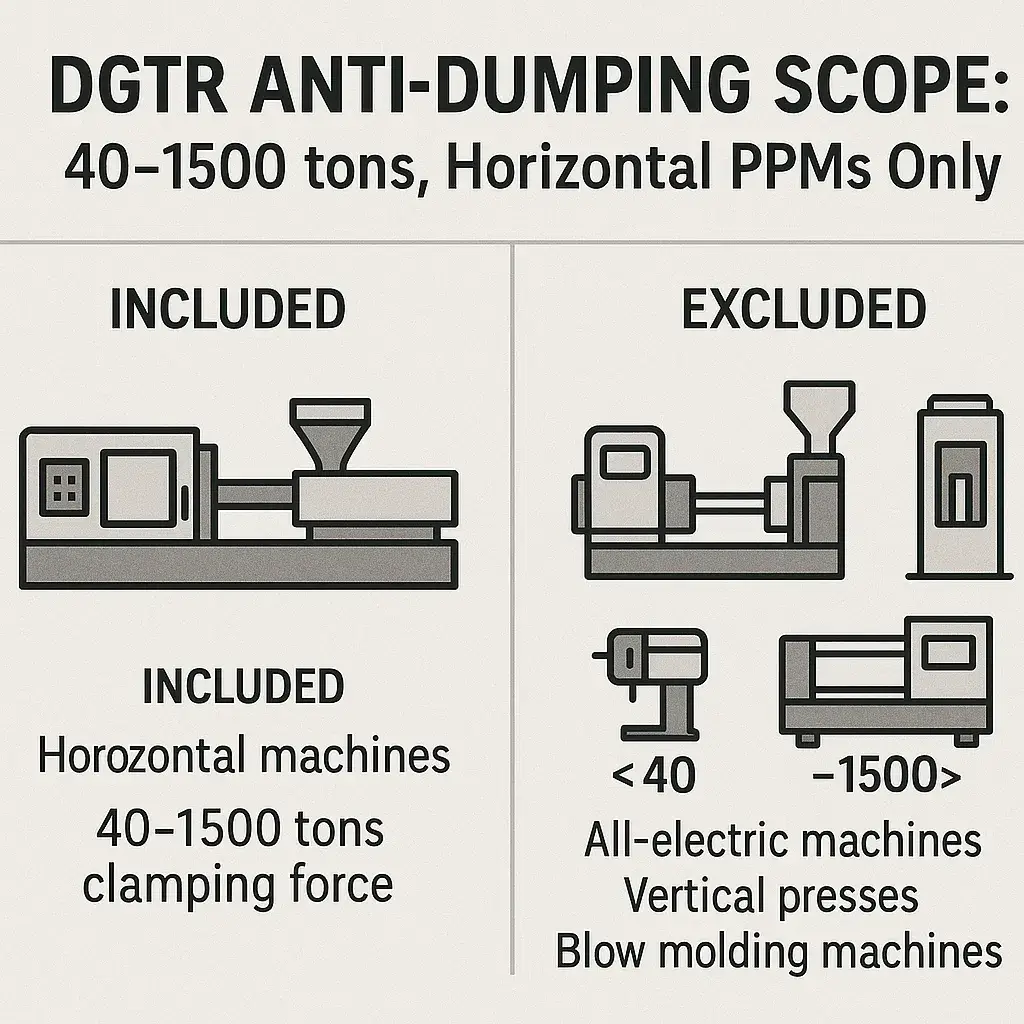

The anti-dumping duties apply to plastic processing machines (PPMs) with clamping forces between 40 and 1,500 tons. Imports from China and Taiwan in fully assembled, CKD, or SKD forms are included.

Exemptions were made for certain types of equipment deemed outside the scope.

- Final Finding: DGTR Notification F. No. 6/21/2023-DGTR (27 March 2025)

- Implementation: Ministry of Finance Notification No. 21/2025-Customs (ADD) (26 June 2025)

Excluded: all-electric machines, vertical injection machines, blow molders, equipment outside the tonnage range, used/refurbished units, and loose parts.

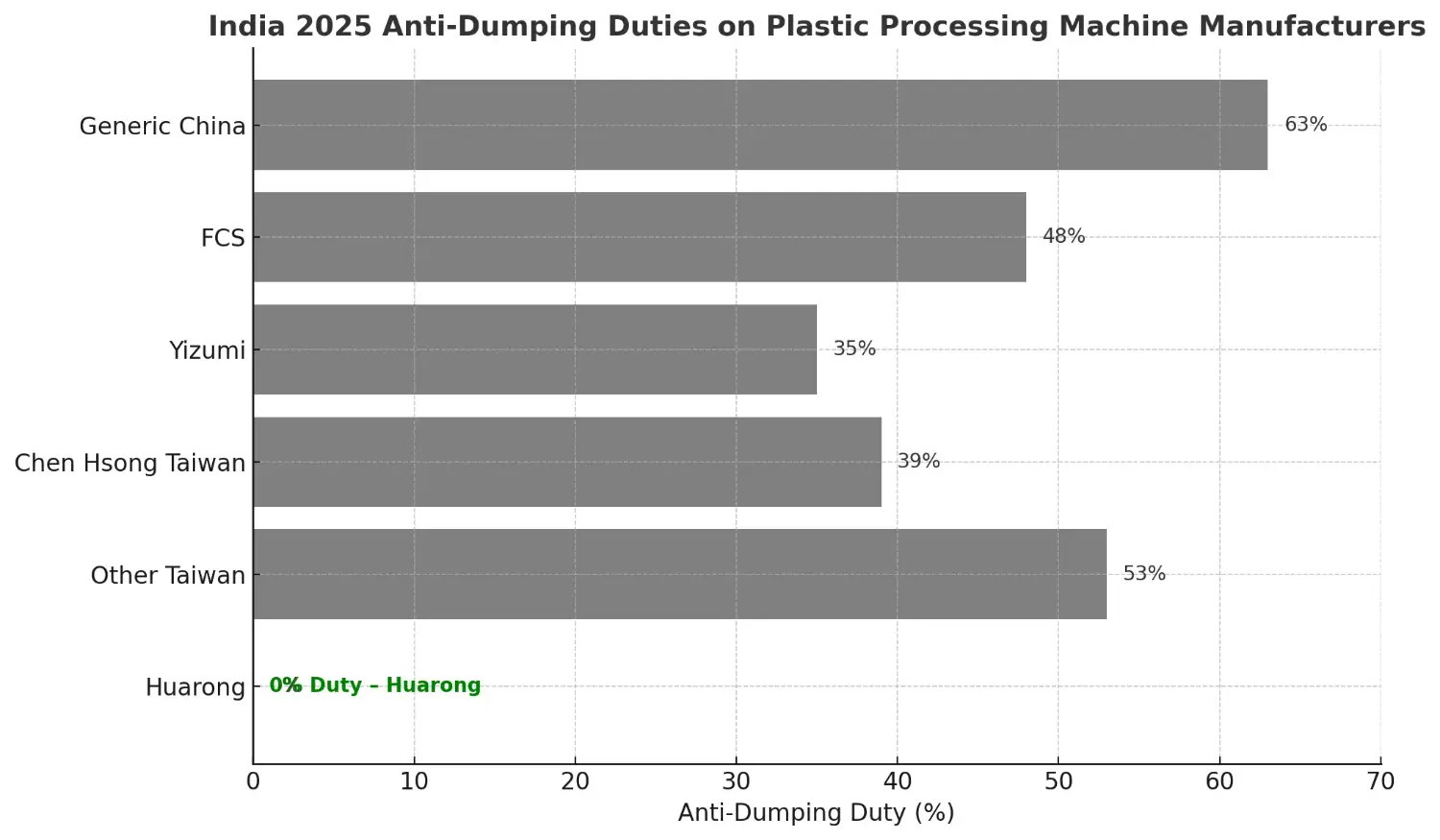

The following table summarizes duty rates by exporter classification, based on India’s official notification.

| Category | Country | Duty Rate* |

|---|---|---|

| Generic Chinese exporters | China | 63% |

| Select cooperating Chinese producers | China | 27–48% |

| Select Taiwanese producers | Taiwan | 39–53% |

| Huarong Plastic Machinery Co., Ltd. | Taiwan | 0% |

Data sourced from Notification No. 21/2025-Customs. Detailed breakdowns are available in the official annex.

DGTR’s investigation applied consistent and objective criteria. Huarong was one of the manufacturers that demonstrated data accuracy, price transparency, and alignment with domestic market values.

DGTR’s evaluation covered:

- Domestic sales conducted in the ordinary course of trade,

- Verified production costs and financial documentation,

- Export transactions and price structures,

- Absence of prohibited subsidies.

Such a comprehensive approach ensures fair treatment and encourages compliance.

For procurement teams, duty classification significantly impacts the total landed cost. Sourcing from a duty-exempt manufacturer like Huarong may offer advantages, including:

- Reduced import tax exposure,

- Fewer documentary and customs complications,

- More stable pricing over multi-year planning horizons.

The following example shows how duties impact purchasing budgets for importers.

- Generic Chinese brand, 500-ton press: USD 180,000 CIF + 63% ADD = USD 293,400 landed

- Huarong, comparable machine: USD 185,000 CIF + 0% ADD = USD 185,000 landed

A significant difference in cost may be attributed entirely to the applied duty rate.

Buyers are reassessing their sourcing strategies by:

- Focusing on verified 0%-duty manufacturers,

- Evaluating equipment types outside the scope (e.g., vertical or all-electric),

- Segmenting RFQs to reduce risk concentration.

Anti-dumping duties are valid for five years and subject to review. Diversifying manufacturer portfolios and engaging with compliant partners may reduce long-term volatility.

Procurement managers can use the following steps to guide their decision-making:

- Verify duty rates through India’s Customs Notification No. 21/2025.

- Recalculate TCO to include duties, logistics, service, and operational costs.

- Allocate savings toward productivity upgrades or automation, including platforms like Huarong HFM.

- Monitor upcoming policy reviews and maintain communication with qualified exporters.

Beyond classification, Huarong continues to focus on technical development and service support. While the 0% duty rate provides an immediate cost advantage, Huarong’s advanced technology ensures long-term operational excellence. For instance, our two-platen machines not only fall within the regulated tonnage but also offer superior efficiency, allowing buyers to maximize the return on their duty-free investment.

- Two-platen injection machines for large-scale automotive parts,

- Microcellular foam technologies for lightweight molding,

- Rotary table double injection molding machine solutions,

- HFM factory management platform for digital production insights.

Our commitment extends beyond customs clearance, with dedicated service hubs and on-site support teams ready to assist our partners across India.

- Service hubs in key markets,

- On-site training and commissioning teams,

- Export compliance processes tailored to customs documentation and audits.

India’s 2025 anti-dumping policy has introduced measurable changes in procurement decisions for plastic processing equipment. Working with duty-exempt and data-transparent manufacturers can help buyers control costs while maintaining regulatory alignment.

While each procurement decision should be based on company-specific priorities, Huarong’s 0% classification and emphasis on compliance make it a reliable option worth evaluating in the context of long-term sourcing plans.

Contact Huarong to explore duty-free options tailored to your production goals.

- Group Name: Huarong Group

- Brand: Huarong, Yuhdak, Nanrong

- Service Offerings: Injection Molding Machine, Vertical Injection Molding Machine, Injection Molding Automation

- Tel: +886-6-7956777

- Address: No.21-6, Zhongzhou, Chin An Vil., Xigang Dist., Tainan City 72351, Taiwan

- Official Website: https://www.huarong.com.tw/

This article is based on official government releases and publicly available materials:

- Directorate General of Trade Remedies (DGTR), India – Final Finding (March 27, 2025)

TPM.in Official Publication - Ministry of Finance, India – Customs Notification No. 21/2025-Customs (ADD) (June 26, 2025)

Official ADD Notification – Scribd PDF - The Economic Times (June 2025) – News coverage on anti-dumping duty implementation

Read Article - TaxGuru (June 2025) – Expert commentary on the customs ruling

Detailed Analysis - Business Standard (April 2025) – Industry-wide summary of DGTR actions

News Summary - World Trade Organization (WTO) – Legal framework and definitions of anti-dumping

WTO Anti-Dumping Gateway

WTO Anti-Dumping Information Page

Readers are encouraged to consult these sources for verification and further insights.